Profitability Works Best When Analysts Agree

Disagreement erodes the profitability premium. This analysis explores how analyst information can improve the signal quality of the profitability factor.

- The profitability premium is strongest when analysts agree on forecasts.

- High analyst dispersion reduces the effectiveness of profitability signals.

- Filtering by analyst agreement can improve factor strategy performance.

How can we improve the profitability factor?

Profitability is one of the most robust equity factors, often associated with higher risk-adjusted returns. But not all profitable firms are created equal. This study shows that the profitability premium is significantly stronger when analysts agree on earnings forecasts and weak or even negative when they disagree.

Using data from July 1976 to December 2024, we combine operating profitability (OP) with a signal of analyst forecast dispersion (FCST DISP) to build a long/short strategy. The results are striking: profitability works best when analysts agree.

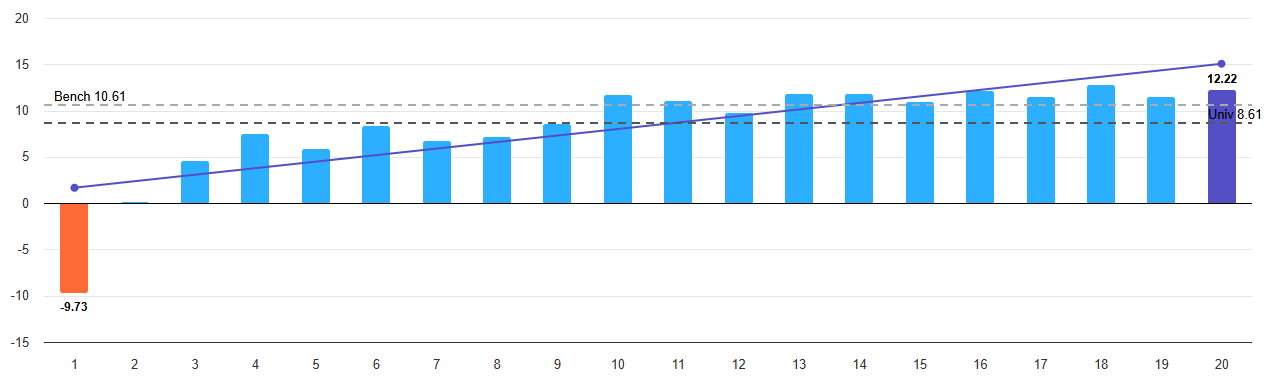

Low Dispersion: Where Profitability Shines

In the low-dispersion regime (analyst forecasts are aligned), the profitability factor generates a strong premium.

The strategy delivers a positive long/short return of 0.66% per month and a statistically significant alpha of 0.61% with a t-stat of 3.36. This is clear evidence that profitability is rewarded when investors share similar expectations.

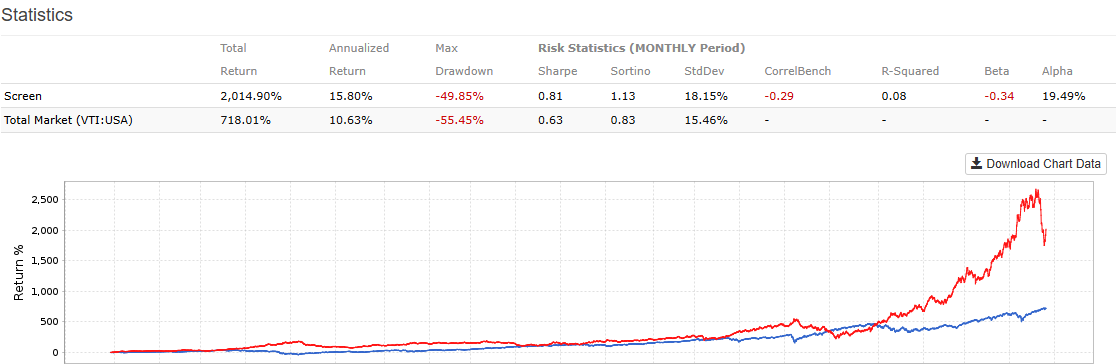

Long/Short Strategy Performance

The long/short profitability strategy in the low dispersion regime has a robust cumulative return profile.

This chart illustrates how the profitability premium compounds meaningfully over time, with relatively low drawdowns, when analyst forecasts are aligned.

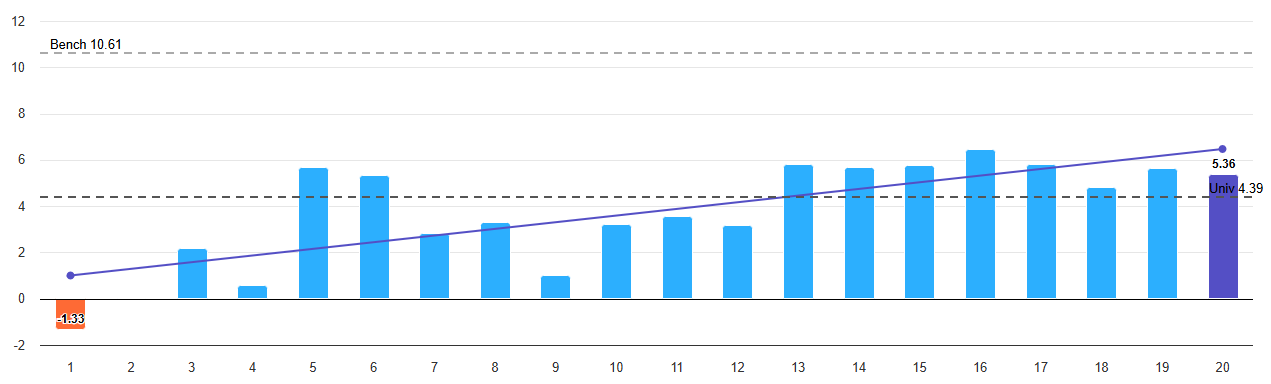

High Dispersion: When Noise Dominates

When analysts disagree, the profitability premium disappears.

In the high-dispersion regime, long/short returns fall to 0.14% per month and alpha collapses to just 0.08% (t-stat 0.50). The profitability signal becomes weak and noisy.

Why Disagreement Matters

Analyst dispersion proxies for uncertainty. When analysts disagree, it indicates that firm fundamentals are harder to interpret, and profitability signals become less reliable. This idea aligns with the theory of “limits to arbitrage” (Shleifer & Vishny, 1997), which suggests that mispricing can persist when information is ambiguous.

In contrast, when information is clear and investors broadly agree, profitability signals are more easily arbitraged and incorporated into prices.

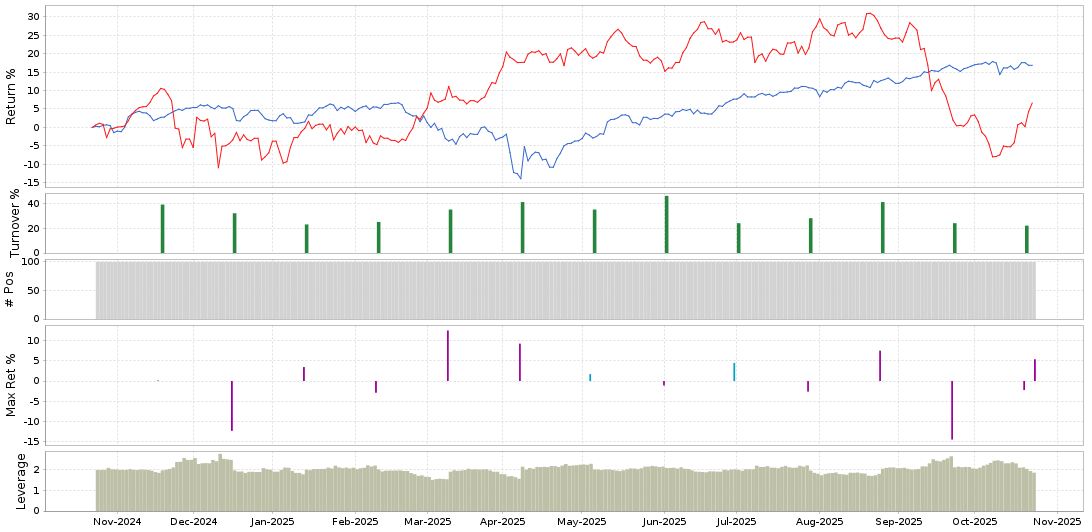

Recent Underperformance and Market Context

The profitability factor has recently underperformed, especially in high-dispersion stocks. This is consistent with the broader shift toward growth and speculative sentiment in 2024–2025.

This divergence reinforces the importance of filtering by analyst agreement to preserve the core profitability premium.

References

- Fama, E. F., & French, K. R. (2006). Profitability, investment, and average returns. Journal of Financial Economics, 82(3), 491–518.

- Novy-Marx, R. (2013). The other side of value: The gross profitability premium. Journal of Financial Economics, 108(1), 1–28.

- Shleifer, A., & Vishny, R. W. (1997). The limits of arbitrage. The Journal of Finance, 52(1), 35–55.

Enjoyed this note?

Get weekly curated research on systematic investing, asset pricing, and machine learning delivered to your inbox.